Things To Do Before Retirement

Saturday, Aug 15, 2020, 7:38 pm

Loading...

1.Refinance

Refinance your home if you still have payments going into retirement. The idea is to be free of debt, or to have very little debt with small payments. When figuring out your retirement income and how you plan to live the rest of your life, it is important that you are not bogged down with large payments.

2.Prepare A Will

Update your will and make sure everything is in order to avoid having the executor of the estate being unable to fulfill your wishes because the will was circumvented. Review your will every five years and make sure to pay special attention to the beneficiaries and accounts attached. Make sure there are allotments for funer@l arrangements.

3.Research Variable Annuities

Variable annuities crete sustainable income during retirement. By being able to take advantage of regular withdrawals now, this can be a form of income during retirement. It works better than having to annuitize and turn your cash balance over to your insurance company to get payments.

4.Review Life Insurance

Life insurance can be expensive at retirement age. Getting term life insurance when you are younger is the way to go, recommended for those who already have debt, dependents and not that many assets. At retirement the opposite is true, raising rates. The sooner you think about this and plan, the more money you will save.

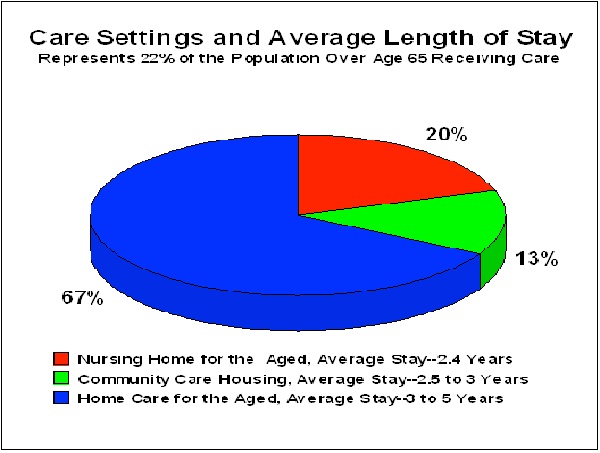

5.Consider Long Term Care Insurance

Consider long term care insurance as a prudent way to avoid losing assets if you suddenly need long term care or need to be put into a nursing home. Planning ahead and making the purchase when you are in your fifties is a great way to cut down on higher rates later in life.

6.Get Out of Debt

Heading into retirement without debt is one of the best things to do. Attack any debt you have as you approach retirement so that you are free of credit card debt, loans, and mortgage. It can be hard to focus on paying off debt rather than doing other things with your money, but it will pay off.

7.Do A House Check

Conduct a house check and if do any renovations pre-retirement. If you plan to live our you life in your home, think about installing showers with lower thresholds or a shower seat, using lever handles on faucets and cabinets, move a bedroom to the first floor. These are things that may creep up later, when money is tight.

Loading...

8.Prepare A Balance Sheet

Showing assets and liabilities on a balance sheet can help determine your net worth. Using an excel sheet is the best way to list all your assets, which should include personal possessions as well. Debts and legal obligations should be included in the balance sheet. Notepad is another option to prepare the balance sheet.

9.Get Rid Of Any College Expenses

If you are retiring while you kids are still in college or are coming up on college age, explore other options for funding, rather than diverting retirement contributions toward it. There are student loan, work programs, grants and scholarships that they can take advantage of, leaving your retirement funds alone.

Loading...

10.Prepare A Budget

Prepare a budget, that includes all costs that you expect to have after retirement. Will you downsize house and car, or keep them? Do you have payments on them? Will you still go out as often, will you be adding any expenses such as tee-times? All of this is important to know what you need to cover each month.

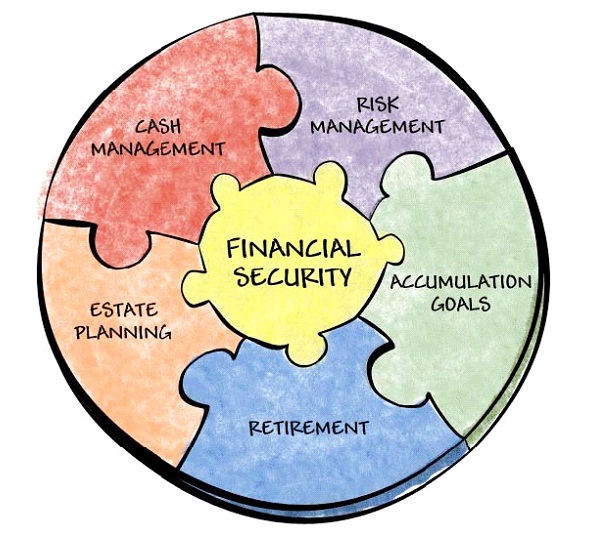

11.Hire A Financial Planner

A financial planner can help you to assess your money situation and determine what you need to live on, and what you have to play with. The age at which you retire is important to how you will live the rest of your life, and a financial planner can help to guide you.

Loading...

12.Decide How You Will Spend YourTime

Before you retire, think about how you want to spend the next years of your life. Is your dream to be on the beach every day, on the golf course, working in a gift shop, volunteering at a hospital? Once you know what you want to do, you can then begin planning.

Report

Loading...

Related Content